Project Portfolio

Forecasting & Prediction Models

Sample Case Study: Market Forecasting in Fintech Predicting digital wallet activity with limited historical data via probabilistic modeling

The Challenge

A research and advisory firm sought to predict the future of mobile wallet usage in the US in 2015, but with digital wallets just emerging, historical data were minimal, so the forecast had to be built from sparse signals and probabilistic assumptions.

The Outcome

Through simulation modeling anchored in early payment data and market conditions, the forecast achieved remarkable accuracy. By 2024, published figures confirmed the model’s 2020 projections were within 2% of actual transaction volumes.

Fintech Market Forecasting Case Study Details

Problem Description

Creating an Accurate Forecast with Very Little Historical Data

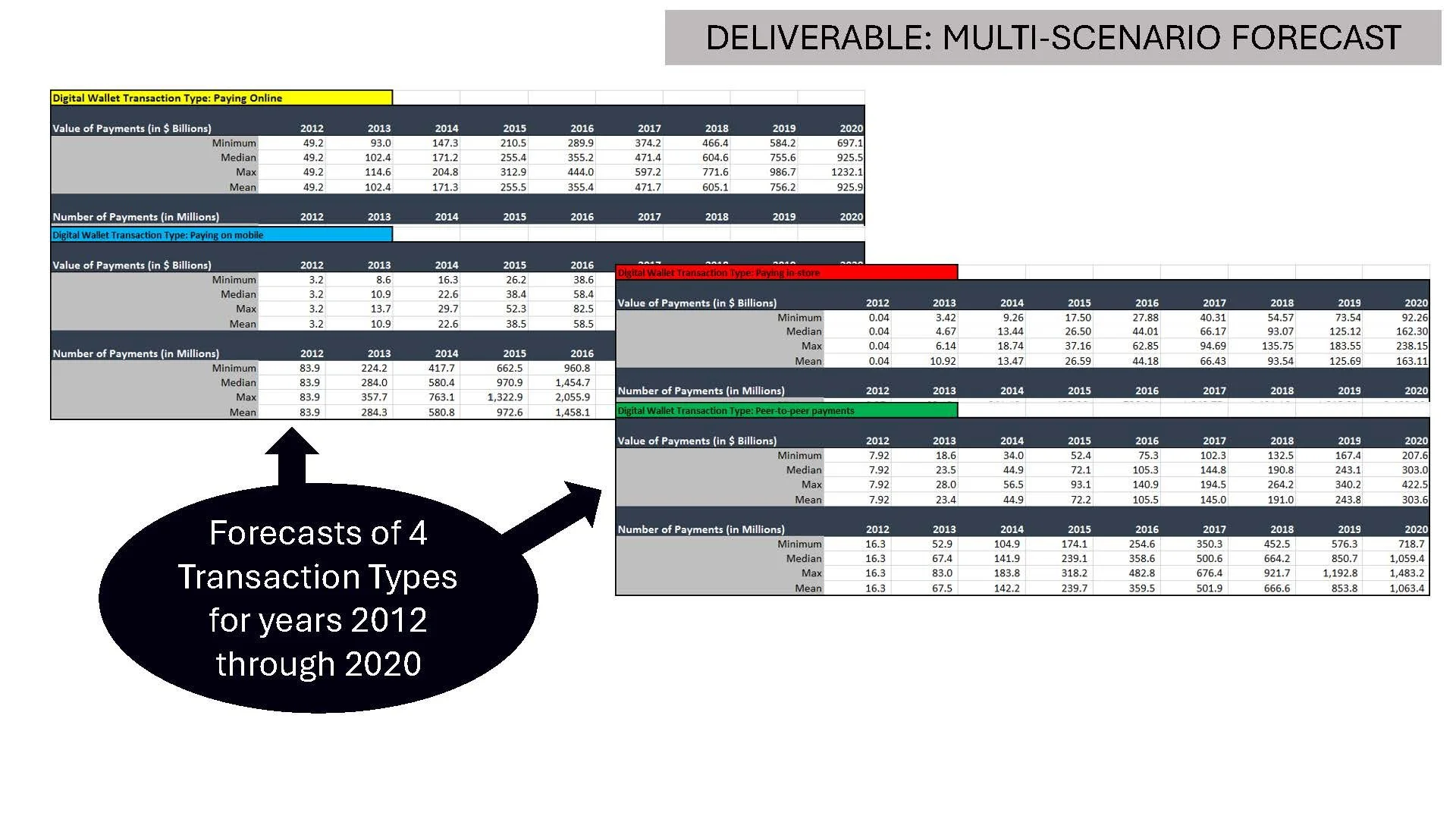

In 2015, a large research and advisory organization sought to identify specific drivers for various payment technology innovations in order to forecast the potential digital wallet market through 2020 in terms of the payments volume in USD and the number of transactions on an annual basis.

The challenge was in the timing.

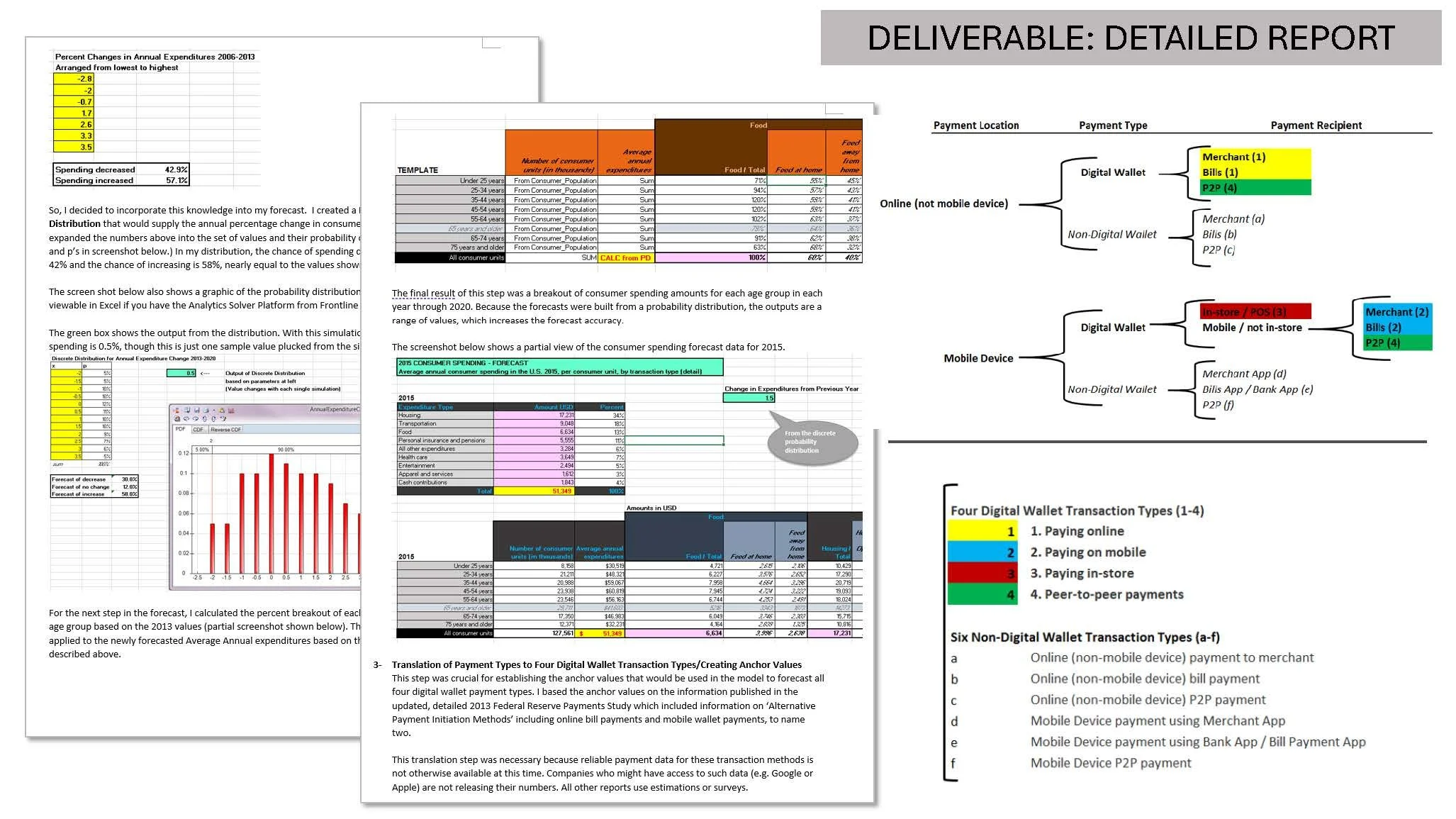

It was very early in the lifespan of digital wallets and digital wallet payments. Apple Pay, for example, had just launched less than 4 months prior to the start of the project. The only available ground truth was payment data from 2012 and 2013. The rest of the forecast had to be built from the ground up from probability distributions, simulations, and lots of research.

Approach

Interconnected probability-based simulation modules

The model employed probability distributions to represent the uncertainty inherent in future values. Outputs were created by running a simulation with 10,000 trials.

The model was anchored to real payment data from 2012 and real consumer spending data from 2012 and 2013 and incorporated the following categories of forecast drivers:

Consumer technology adoption

Merchant technology adoption

Digital wallet availability & attractiveness

Outcomes / Impact

Remarkable Accuracy When Compared to Actual Values

According to data published by Statista in 2024, the market size of digital wallet transactions for the US in 2020 (specifically transactions on mobile phone or in-store) was $ 503B. This falls precisely within the median and maximum 2020 values for these two transaction types from my forecast, which were $347B and $513B, respectively.

Another source – Grand View Research - published a report in 2023 with historical figures on the US Mobile Wallet Market and reported the total 2020 US Mobile Wallet market at $914M. The minimum value across all four transaction types in my model for 2020 was $1.11B. This is 21% larger than the actual value, but still remarkably close given the paucity of data to work with in 2015.

Fintech Market Forecasting Case Study Images

More Examples of Forecasting & Prediction Models

Health Impact Prediction Model for Social Care Initiative in UK

Healthcare / Biotechnology

Conducted extensive research into the quantifiable impacts of social care inputs (e.g., community micro-enterprises, volunteer programs) on healthcare utilization and costs. Drawing on academic research, NHS data, and other reputable sources, developed a 3-year, dynamic, scenario-based Social ROI (SROI) forecast model to support strategic planning for an experimental initiative in the UK.

Predicting & Ranking Real Estate Investment Property Leads

Real Estate

Designed a ranking and classification algorithm to identify properties in the northeastern US most likely to be candidates for sale to a real estate wholesaler. The project aimed to pinpoint distinguishing property features correlated with higher conversion probability and to establish a basis for expanding and generalizing the model for use in other regions.

Multi-Scenario Financial Forecast for Biotech Company

Healthcare / Biotechnology

Refactored, refined, and expanded a multi-scenario, 20-year financial forecasting model for a burgeoning biotech company developing RNA-based vaccines and therapies. The financial forecast model was based on an array of pertinent factors including, but not limited to, differing scenario-based probabilities of success across successive clinical trial stages for therapeutic candidates in nine functional pipelines and time-dependent batch cost amounts calculated using decay functions unique to each asset.

Predicting & Ranking Roof Repair Customers in Southern Florida

Manufacturing / Construction

Developed a ranking and classification model to identify the residential properties in two Florida counties most likely to require roof repair services due to damage from Hurricane Irma (2017). The model integrated selected and transformed features from two key data sources: nearly 700K property records from publicly available county datasets, and a purchased dataset containing ~1 million observations across more than 1,000 demographic and psychographic attributes.

Diagnostic Audit & Update Plan for Custom Builder's Revenue Forecast Model

Manufacturing / Construction

Executed a diagnostic audit and review of a monthly revenue forecast model used by a custom builder in Australia that tended towards over-estimating revenues in the near term. The deliverable was a detailed model update plan to correct the over-estimation problem and provide additional predictive accuracy.

SEM Based Classification Models for Product Usage

Consumer Goods / Retail

Created a suite of exploratory structural equation models (SEM) using data from a large-scale consumer survey focused on personal care products sold by a major multinational corporation. The models aimed to uncover the latent (non-directly observable) drivers influencing product usage within the target market. Accompanying dendrograms and logistic regression models provided additional support for relationships examined in the SEM path diagrams.